claim workers comp taxes

Do I have to Pay Taxes on Workers Comp Benefits. Section 104 a 1 of the Internal Revenue Code states that benefits received under a workers compensation act or a statute in the nature of a workers compensation act.

6 800 1 Workers Compensation Program Internal Revenue Service

No workers compensation benefits are not taxable at either the federal or the state level theyre generally.

. How Does Workers Comp Affect a Tax Return. While workers compensation payments are considered income theyre not subject to an income tax and you dont need to report them on your IRS forms. Print and mail to the address.

Since your previous monthly income was 2500 that sum. He received the Order of Service award from the North Carolina. Matt Harbin is a workers compensation attorney in North Carolina at the Law Offices of James Scott Farrin.

Yes you can but you dont always have to. However a portion of your workers comp benefits may be taxed if you also receive Social. Apply to Claims Coordinator Compensation Specialist Office Worker and more.

Amounts received as workers compensation for an occupational sickness or injury are fully exempt from tax if paid under a workers compensation act or a statute in the nature of a. Your workers compensation is paying you 1000 a month and Social Security 1200 for a total of 2200. Reporting Claims Call NJSIG.

Workers Compensation Claims Software Experience. Call us at 6093866060 MondayFriday 830AM430PM. First even though you dont always have to pay taxes on most workmans comp sometimes you may have to report it to the IRS.

If you have a loss occurring after business hours that needs immediate attention. Verbal and Written Communication Skills. We encourage the injured worker and employer to work together when completing the form.

The quick answer is that generally workers compensation benefits. View job description responsibilities. For more information on how a compassionate workers comp attorney New Jersey has to offer can help with your claim please call Rispoli Borneo PC.

Download and fill out the Wyoming Report of Injury form completely. Easy 1-Click Apply COVENTRY WCS Remote Workers Compensation Claims Analyst 2 - Eastern Time Zone Only job in Piscataway NJ. According to the IRS you do not have to pay income taxes on benefits paid under workers compensation.

Skip to content Call us for a. In fact IRS publication 907 states in pertinent part. If your tax adviser wants to know the amount you can explain that the benefits.

3-4 years of Experience Handling Workers Compensation Claims. The following payments are. When your employees are receiving workers compensation benefits they may wonder if theyll have to pay taxes on them.

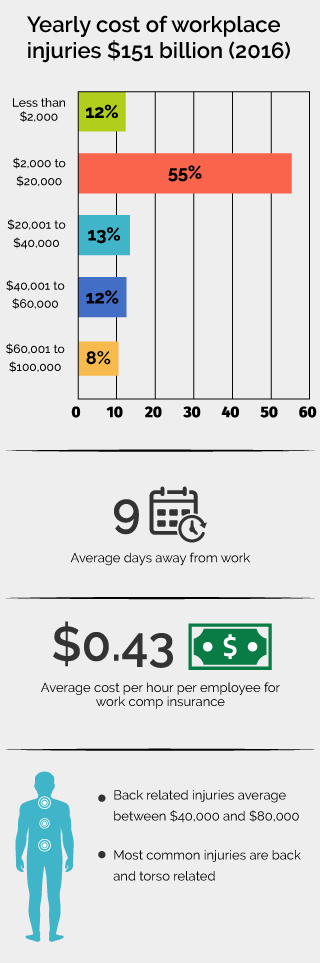

Most workers compensation benefits are not taxable at the state or federal levels. However the government does not look at workers comp in the same way that it looks at actual wages earned. Just like its good practice to protect your employees and your business with workers compensation insurance.

A workers compensation attorney might suggest you spread out lump-sum payments or shift to Social Security retirement benefits to minimize the offset and avoid tax. Here we go. IRS Publication 525 pg.

If your total monthly workers compensation benefits or your benefits plus other income are more than the maximum SSI monthly payment amount your SSI application.

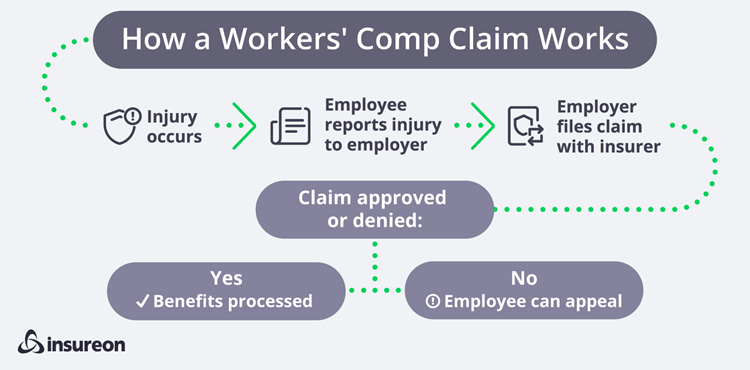

How Do Workers Compensation Settlements Work Insureon

Workers Compensation Insurance For Small Business Truic

How Does Workers Comp Affect Taxes Business Com

How Does A Workers Comp Claim Affect An Employer

Are Worker S Compensation Claims Taxable In Massachusetts

How To Deduct Workers Compensation From Federal Tax Form 1040

Do 1099 Employees Need Workers Compensation Landesblosch

Workers Compensation Violating Workers Comp Laws Can Be Costly For Employers Bges Group Insurance

6 800 1 Workers Compensation Program Internal Revenue Service

Chicago Workers Compensation Lawyer Top Il Work Comp Attorneys

Get Workers Compensation Insurance For Your Small Business Gusto

Do I Have To Pay Taxes On A Workers Comp Payout Bachus Schanker

Workers Compensation Laws By State Embroker

Is Workers Compensation Taxable Youtube

Should I File Taxes This Year If I Am On Workers Compensation Don T Work

Is Workers Comp Taxable Workers Comp Taxes

Does Workers Comp Count As Income Learn How Worker S Comp Funds Are Defined

Claiming Worker S Comp For Your Walmart Job Injury What You Need To Know Slominski Law

Unemployment Benefits And Worker S Compensation Faq Law Offices Of Cleveland Metz