kansas sales tax exemption application

Ad Download fax print or fill online 79-201 Ninth more Subscribe Now. How to use sales tax exemption certificates in Kansas.

Complete a Kansas Business Tax Application.

. Harbor Compliance can obtain Kansas sales tax exemption for your 501c3 nonprofit. There are three parts to your Kansas Sales Tax Account Number. TX Application Form pdf Additions to Property Tax Exemption Application.

The certificates will need. Kansas Application for Sales Tax Exemption Certificates KS-1528 Kansas Exemption Booklet KS-1520 This publication assists businesses to properly use Kansas Sales and. Step 2 Identify the sellers name business address Sales Tax Registration Number and.

BEFORE THE BOARD OF TAX APPEALS OF THE STATE OF KANSAS TAX EXEMPTION KSA. He earned his law degree in 1979 from the. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making.

In Kansas this sellers permit lets your business buy goods or materials rent property and sell products or services tax free. Complete this application using the instructions that begin on page 3. Entries are required on all fields marked with an asterisk.

KANSAS SALES AND USE TAX REFUND APPLICATION. While the Kansas sales tax of 65 applies to most transactions there are certain items that may be exempt from taxation. Therefore you can complete the resale exemption certificate form by providing your Kansas Sales Tax Registration Number.

Register for a Kansas Sales Tax Permit Online by filling out and submitting the State Sales Tax Registration form. TAP allows North Dakota business taxpayers to electronically file returns apply for permits make and view. Your Kansas sales tax account number has three distinct parts.

Ad 79-201 Ninth More Fillable Forms Register and Subscribe Now. _____ Applicant Name Owner of Record. Tax Exemption Application Page.

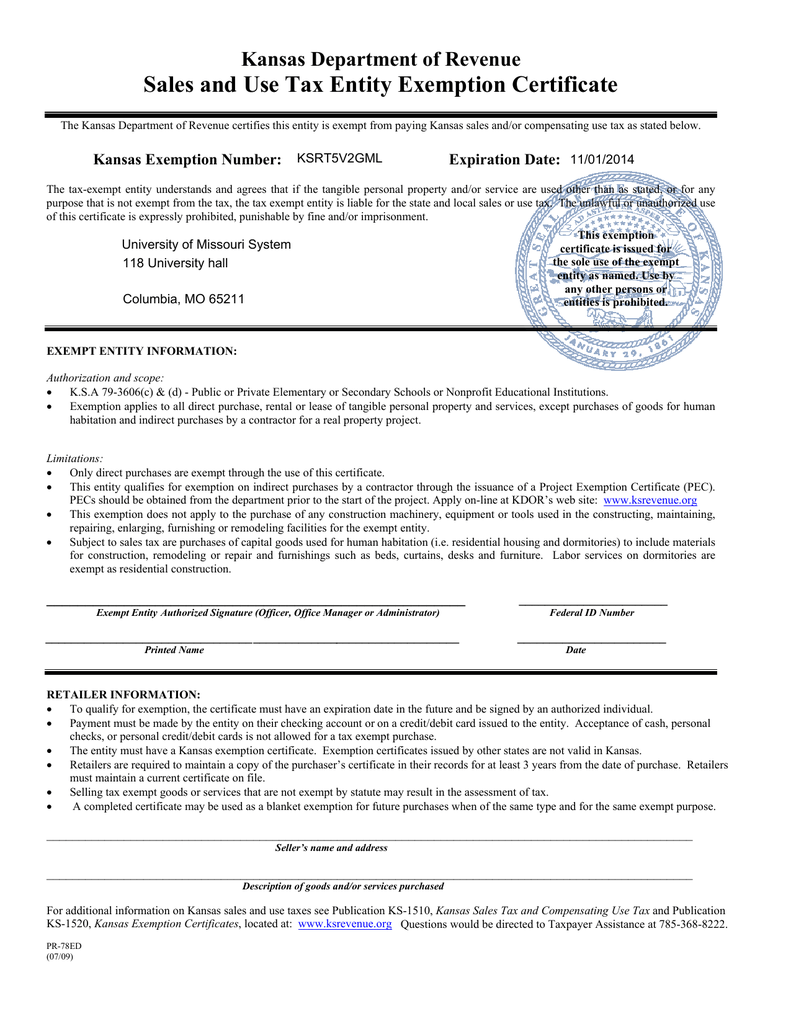

Sales Tax Entity Exemption Certificate Renewal On November 1 2014 the sales tax exemption certificate issued by the Kansas Department of Revenue will expire. Kansas law KSA 40-252d provides for a tax credit for insurance companies equal to 15 percent of Kansas-based employees salaries or up to a maximum of 1125 percent of taxable premiums. Manage your North Dakota business tax accounts with Taxpayer Access point TAP.

Step 1 Begin by downloading the Kansas Resale Exemption Certificate Form ST-28A. Current Format of Sales Tax Account Numbers A Kansas Sales tax account number is a fifteen-character number. Kansas Sales And Use Tax Entity Exemption Certificate.

This page discusses various sales tax exemptions in Kansas. 800 524-1620 Sales Tax Application Organization. Be either a manufacturer or able to document that most of its sales are to Kansas manufacturers andor out-of-state businesses or government agencies.

Ad Register and Subscribe Now to work on KS Exemption Certificates more fillable forms. For additional information on Kansas sales and use taxes see Publication KS-1510 Kansas Sales Tax and Compensating Use Tax and Publication KS-1520 Kansas Exemption Certificates. If you are accessing our site for the first time.

Obtaining your sales tax certificate allows you to do so. A sales tax exemption that will be. Entries are required on all fields marked with an asterisk.

Thank you for using Kansas Department of Revenue Customer Service Center to manage your Department of Revenue accounts. This permit will furnish your business with a unique sales tax number. 1320 Research Park Drive Manhattan Kansas 66502 785 564-6700 The information contained in this handbook is for informational purposes only and is to be used as a resource.

How to apply for Kansas sales tax exemption. If you are applying for a property tax exemption pursuant to the following statutes you must attach a completed. The format of this sample can be used to create legally valid exemption certificates to be filed with a seller at the time of a purchase.

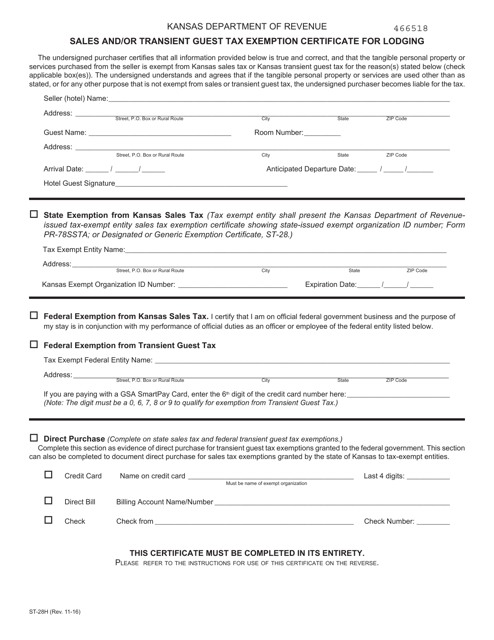

Form St 28h Download Fillable Pdf Or Fill Online Sales And Or Transient Guest Tax Exemption Certificate For Lodging Kansas Templateroller

Fillable Online Kansas Sales And Use Tax Exemption Certificate Um Infopoint Fax Email Print Pdffiller

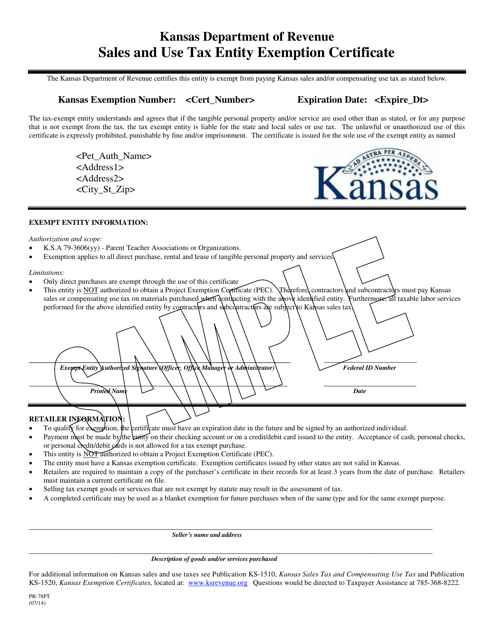

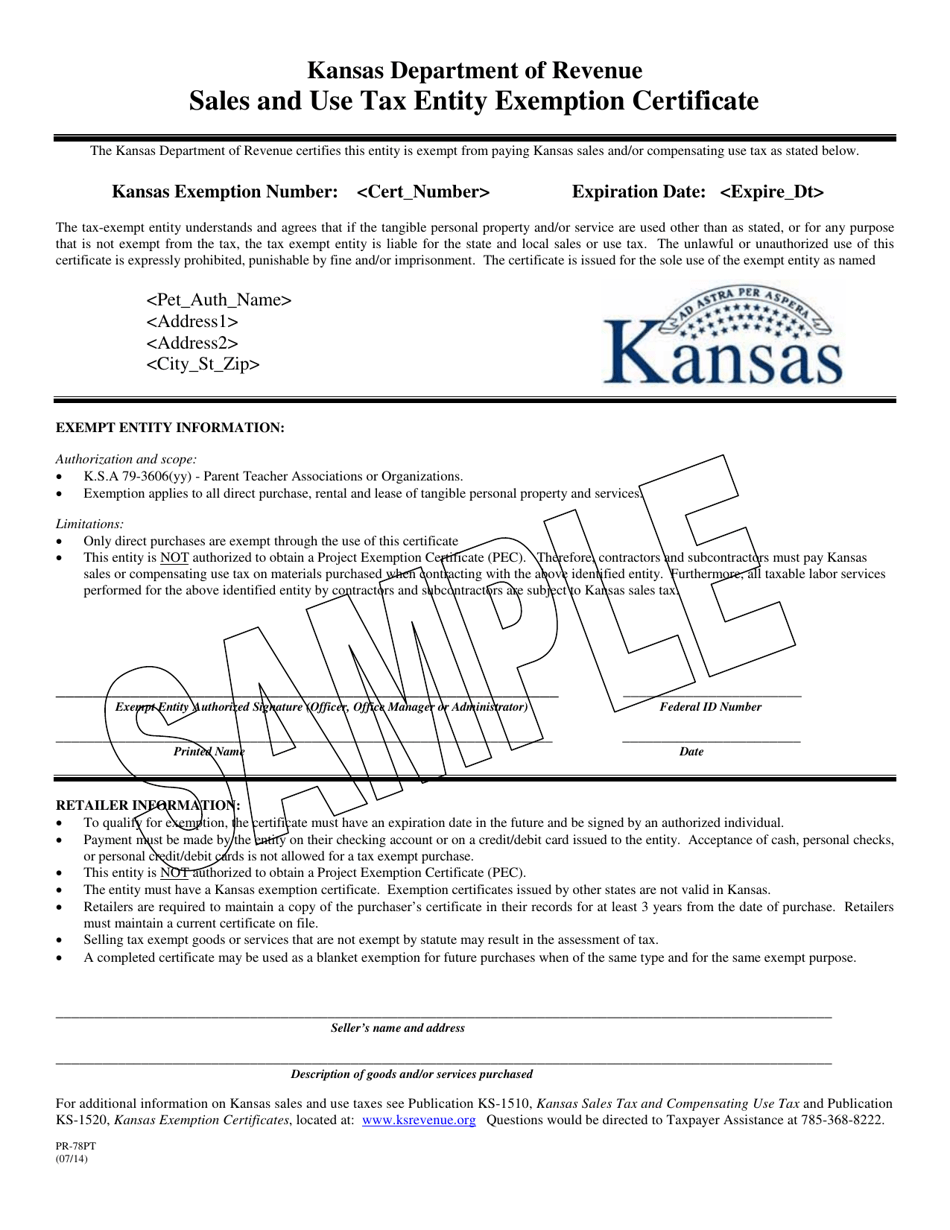

Form Pr 78pt Download Printable Pdf Or Fill Online Sales And Use Tax Entity Exemption Certificate Parent Teacher Association Sample Kansas Templateroller

Form Pr 78pt Download Printable Pdf Or Fill Online Sales And Use Tax Entity Exemption Certificate Parent Teacher Association Sample Kansas Templateroller

Sales And Use Tax Entity Exemption Certificate Kansas Department Of Revenue

Form Pec Entities Fillable Sales And Use Tax Refund Application For Use By Project Exemption Certificate

Form St 8b Fillable Affidavit Of Delivery Of A Motor Vehicle Semitrailer Pole Trailer Or Aircraft To A Nonresident Of Kansas

Fillable Online Baldwincity Kansas Department Of Revenue Baldwincityorg Fax Email Print Pdffiller

Pr 78 Fill Online Printable Fillable Blank Pdffiller

Kansas Exemption Form Fill Out And Sign Printable Pdf Template Signnow

Fill Free Fillable Kansas Department Of Revenue Pdf Forms

Form Pec Entities Fillable Sales And Use Tax Refund Application For Use By Project Exemption Certificate